Diego Thomazini/iStock via Getty Images

Volatility continues in the stock market.

Only this past week, the stock market closed higher. In the week before, the Dow Jones Industrial Average had fallen for the eighth week in a row.

This was the longest “down” streak the Dow has had since 1932! This is important! But it should also be noticed that the S&P 500 and the NASDAQ had, in the previous week, fallen for seven weeks in a row. So, we finally have an “up” week to talk about.

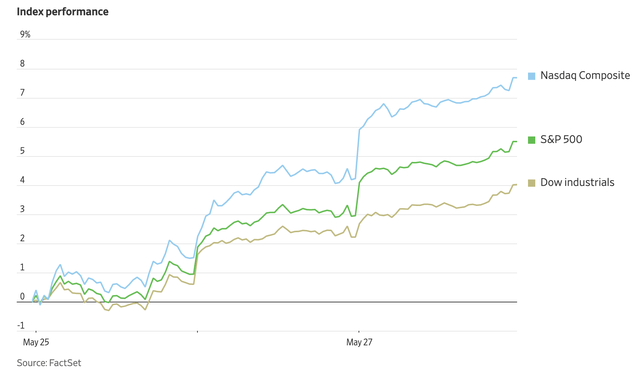

STock market–Last week (Wall Street Journal)

And, what caused the “up” week? Well, there were a number of earnings results, especially in the retail sector, that were positive for investors. Then there was a slight easing in inflation in April.

And, also, there was some feeling in the market that the “worst-case” scenarios were over. There was a feeling that the Federal Reserve had shown the market the future. Two more increases in the Fed’s policy rate of interest of 50 basis points each, and then the Fed’s move was over.

Maybe, Fed Chairman Jerome Powell was “topping out.”

Stocks, some investors claimed, had fallen too far, too fast. But the question still remains, has a bottom in stock prices really been reached?

I Don’t Think So

I don’t believe that we have reached a bottom. The major fear running through the investment community right now is uncertainty. I have written about this for many weeks now. We are in a period of radical uncertainty. There are a lot of known unknowns out there. But, as I have written elsewhere, there are also a lot of unknown unknowns.

The uncertainty we face right now is one where there are a lot of possible outcomes that we can’t put our finger on. I mean, for example, the Russian invasion of Ukraine was an unknown unknown two months ago.

Even some of the known unknowns are hard to understand. What about the future of Covid-19? I haven’t heard any convincing arguments about when this little problem will go away. And then there are the supply chain problems.

We can’t really seem to get a handle on these. What about the baby food shortage? What is the Fed really going to do? And, on and on.

There are just too many things that are still hanging in the wind. We see the VIX index is now maintaining a level of just under 30.00. The University of Michigan’s consumer sentiment index fell to the lowest level since August 2011.

And, there is more.

What’s Happened?

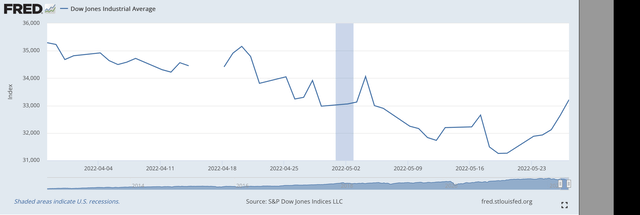

The S&P 500 Stock Index hit its last new historical high on January 3, 2022. Both it and the other two major indexes have been going downward since. The Dow Jones result is perhaps the most dramatic. Eight weeks in a row, the Dow Jones fell.

Dow Jones Industrial Index (Federal Reserve)

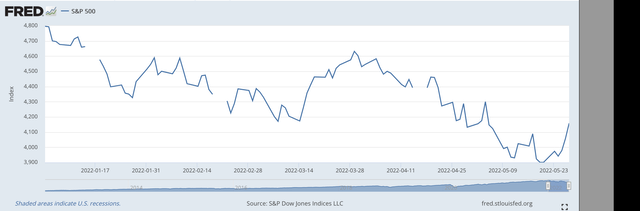

Let’s take a little look at the S&P 500 move since January 3.

S&P 500 Stock Index (Federal Reserve)

This chart is particularly important because it shows up just how volatile the stock market has been during this market decline. And, this is the point. Investors are facing the dilemma of radical uncertainty. The markets are going to swing.

The Federal Reserve is going to continue to tighten up on monetary policy with the possibility that the effective Federal Funds rate, which is at 0.83 percent right now, will approach 3.00 percent, 5.00 percent, or more. Some experts are even seeing the effective Federal Funds rate going as high as 8.00 percent.

The stock market, in my mind, will not be going up during 2022 and possibly into 2023. But there is a lot of uncertainty surrounding this. What is going to happen in Ukraine? What is going to happen in China? What is going to happen in the Middle East? And so on and so forth.

This is my picture of the future.

from WordPress https://ift.tt/mqNGAxk

via IFTTT

No comments:

Post a Comment