DNY59/iStock via Getty Images

Two things capture the stock market right now.

The first is concern over just what the Federal Reserve is going to do with respect to monetary policy over the next year.

The second is the uncertainty that pervades the market.

I have written quite a bit lately about radical uncertainty and the role it is playing in the stock market.

Radical uncertainty occurs when you cannot identify all the possible outcomes that might occur in the future, let alone assign probabilities to each outcome.

For example, on Monday, January 3, 2022, the day that the S&P 500 stock index hit its most recent historical high, who was including the possibility that Russia might invade Ukraine sometime this year?

On January 1, 2020, who was including a global spread of the Covid-19 virus that would impact millions of people in their forecasts for the year?

And, these are just the bigger items.

We are going through a period of radical uncertainty where many possible outcomes for the future are totally off the charts as far as being able to identify them, let alone assign a probability to their occurrence.

And, many of these uncertainties apply to the future policies of the Federal Reserve System.

How does this uncertainty work its way into the stock market?

Through volatility.

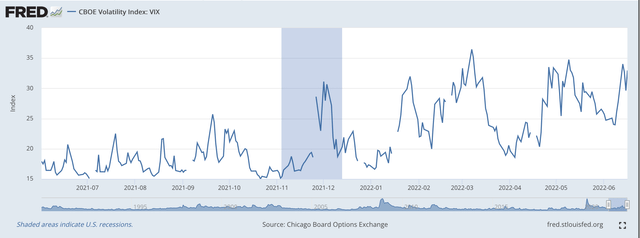

Take a look at the VIX index, a measure of the stock market’s volatility.

VIX Volatility Index (Federal Reserve)

The initial date for this chart is June 1, 2021, just a little over one year ago.

Volatility, as measured by the VIX index, has picked up during the year.

That is, the volatility of stock prices is much greater now than it was one year ago.

And, one can say that uncertainty has picked up substantially over the past year.

I do not expect that volatility is going to decline over the next 12 months.

So, investors are going to have to include this fact in their investment strategies.

Federal Reserve Actions

But, in addition to all the volatility that will be experienced in the stock market, the best guess for the direction of the stock market over the next year is downwards.

The S&P 500 stock index entered bear market territory this past week. That is, it dropped more than 20 percent below its last historical high, achieved on January 3, 2022.

And, the Fed is just beginning the real painful part of its restrictive monetary policy.

Last week, the Fed raised the range for its policy rate of interest by 75 basis points.

Talk about uncertainty, last week at this time, a 75-basis point rise in the Fed’s target range did not even seem to be on the books. I would have put the probability of such an increase at close to zero percent.

Then, we got new inflation numbers.

Up went the target range.

Additional increases are expected in July and August. Right now, I think that each is in for a 50-basis point increase.

Then what comes in September?

In addition to changes in the Fed’s policy rate of interest, the Fed will start this week to reduce the size of its securities portfolio.

The Fed is not going to “sell” securities. The Fed is just going to allow securities to “mature off” its balance sheet.

In the next three months, the Fed is going to allow $30.0 billion of U.S. Treasury securities to mature off its balance sheet and will allow $17.5 billion of mortgage-backed securities to mature off its balance sheet.

The total is $47.5 billion per month.

After that, the plan is for the Fed to double these numbers each month so that its securities portfolio will decline by $95.0 billion every month…until the middle of 2024.

The Fed’s securities portfolio now stands at $8.5 trillion. This “quantitative tightening” will reduce this portfolio by a little more than $2.0 trillion.

Concerns

But, there are concerns surrounding this program.

For one, the stock market has moved into “bear” territory.

Particularly in an election year, a declining stock market will raise loud shouts of discontent. Many voters are not going to like going into the ballot box with a declining stock market.

But, what about the other assets that have benefitted from the large quantity of reserves the Federal Reserve has pumped into the banking system over the past two years or so.

One such area being impacted by the Fed’s withdrawal from the financial markets is the area titled SPACs or Special Purpose Acquisition Companies, or, “blank check companies.”

I have written earlier about the massive amount of funds leaving this area of the market and the losses that are being accrued due to the reversal of money flows.

Another area of major interest is the cryptocurrency market. The price of Bitcoin rose in a major way as a result of the Fed pumping so much money into the financial markets.

On November 9, 2021, during the discussion about when the Federal Reserve was going to start “tapering” its monthly purchase of securities, the price of the Bitcoin peaked at slightly more than $67,000.

Bitcoin has now dropped below $20,000.

The air is out of the bubble.

But, the air is coming out of a lot of markets these days.

The question becomes, how long can the Fed stand for a major drop in financial markets, going far beyond just the stock market.

Lots and lots of uncertainty.

The Future

And, so we move on into the future.

Remember, the Fed is just starting to reduce the size of its securities portfolio.

The best the investor can do in a world of “radical uncertainty” is to develop a narrative relating to the way events might evolve. A “narrative” will be more general than what the investor builds when there is greater certainty in the world, but it provides some benchmark by which the investor can compare what actually takes place versus what the investor thinks might take place.

In that way, the investor still is making a judgment about whether or not money should be invested and where it should be invested.

Working in such a world, however, the investor needs to be more aware of what is taking place and more agile in terms of where the money is placed.

This would mean that the investor should be more liquid than otherwise and less tied to the longer term.

A narrative like, “the Fed will be extremely tight during the next six months, pushing up interest rates aggressively while substantially reducing the size of its securities portfolio” can be differentiated from a narrative in which the investor thinks, “the Fed is going to back off a tight policy soon if the stock market crashes because it just cannot let the market fall dramatically.”

These are much more general pictures of what might take place in the near future and lend some guidance on how an investor should construct his/her portfolio. But, it is very loose. It requires a constant appraisal.

But, that is the nature of the times. And, investment strategy must adjust with the nature of the times.

from WordPress https://ift.tt/mFXD46x

via IFTTT

No comments:

Post a Comment